The Wells Fargo Zelle Rip-off: A Deep Dive right into a Rising Menace

The rise of peer-to-peer (P2P) fee apps has revolutionized the best way we ship and obtain cash. Providers like Zelle, built-in into many main banks together with Wells Fargo, provide velocity and comfort. Nonetheless, this comfort has additionally created a fertile floor for stylish scams that prey on unsuspecting customers. One significantly prevalent and damaging rip-off includes fraudulent calls claiming to be from Wells Fargo, trying to trick victims into sending cash through Zelle. This text will discover the intricacies of this rip-off, its strategies, its influence, and what you are able to do to guard your self.

Understanding the Wells Fargo Zelle Rip-off

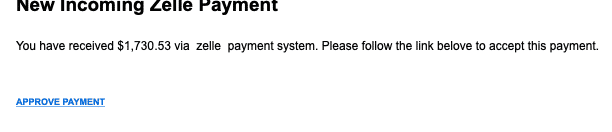

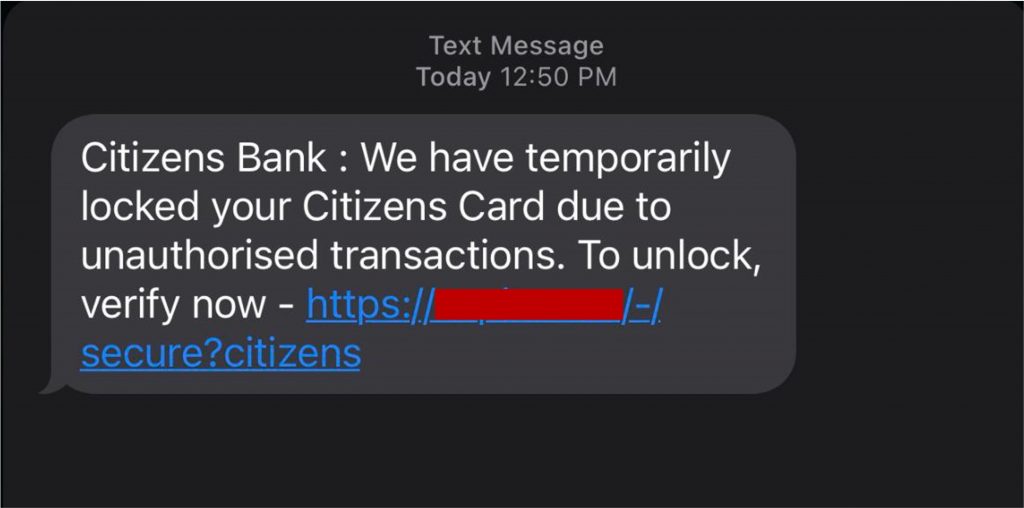

The Wells Fargo Zelle rip-off sometimes unfolds via a telephone name. The scammer, typically utilizing spoofed numbers that seem like official Wells Fargo telephone numbers, will contact the sufferer, claiming to symbolize the financial institution’s fraud division or customer support. They may start by expressing concern about suspicious exercise on the sufferer’s account, maybe a big, unauthorized transaction or a compromised account. The urgency and authority they mission are designed to instill worry and panic, overriding rational thought.

As soon as the sufferer is hooked, the scammer will information them via a sequence of steps, ostensibly to safe their account. This would possibly contain "verifying" private data, together with account numbers, social safety numbers, and passwords. Critically, the scammer will then instruct the sufferer to ship a selected amount of cash through Zelle to a chosen recipient, typically claiming it is necessary to "reverse" a fraudulent transaction or "safe" their funds. That is the crux of the rip-off. As soon as the cash is shipped through Zelle, it is nearly untraceable and irretrievable.

The Techniques Employed by Scammers

The success of this rip-off depends on a number of key ways:

- Spoofed Numbers and Caller ID Manipulation: Scammers make the most of expertise to make their telephone quantity seem as a official Wells Fargo quantity on the sufferer’s caller ID. This instantly lends credibility to their claims and makes it more durable for victims to discern the fraud.

- Making a Sense of Urgency: The scammers create a way of rapid hazard, typically claiming the sufferer’s account is about to be frozen or that their funds are in danger. This strain discourages victims from taking time to confirm the data.

- Exploiting Belief in Establishments: The scammers leverage the belief folks place in established establishments like Wells Fargo. Using the financial institution’s identify and the perceived authority of the caller make the rip-off extra plausible.

- Subtle Social Engineering: The scammers are expert social engineers, able to manipulating conversations and exploiting emotional vulnerabilities to extract data and cash from their victims. They tailor their strategy to every particular person, utilizing data they could have gleaned from public sources or earlier information breaches.

- Use of Zelle’s Irreversibility: Zelle’s velocity and irreversible nature are exploited to the scammer’s benefit. As soon as the cash is shipped, it is practically inconceivable to recuperate.

The Affect of the Rip-off

The monetary penalties of falling sufferer to this rip-off may be devastating. Victims typically lose vital sums of cash, generally their whole life financial savings. Past the monetary losses, the emotional toll may be substantial. Victims might expertise emotions of disgrace, embarrassment, anger, and betrayal. The emotional misery may be long-lasting and considerably influence their psychological well-being.

Moreover, these scams contribute to a broader erosion of belief in monetary establishments and expertise. The convenience with which scammers can impersonate official organizations undermines public confidence and creates a local weather of worry and suspicion.

Defending Your self from the Wells Fargo Zelle Rip-off

A number of steps may be taken to guard your self from turning into a sufferer of this rip-off:

- Confirm the Caller’s Id: By no means present private data or ship cash to somebody who contacts you unsolicited. If you happen to obtain a name claiming to be from Wells Fargo, dangle up and independently contact the financial institution utilizing a telephone quantity you understand to be official, discovered on their official web site.

- Be Cautious of Urgency: Official monetary establishments hardly ever demand rapid motion. If somebody pressures you to behave rapidly, it is a main purple flag.

- By no means Share Delicate Data Over the Telephone: Banks won’t ever ask in your password, social safety quantity, or different delicate data over the telephone.

- Report Suspicious Calls: Report any suspicious calls or emails to the authorities and to Wells Fargo’s fraud division.

- Educate Your self and Others: Keep knowledgeable about widespread scams and share this data with family and friends.

- Use Robust Passwords and Multi-Issue Authentication: Shield your on-line accounts with robust, distinctive passwords and allow multi-factor authentication every time doable.

- Commonly Monitor Your Financial institution Accounts: Examine your accounts frequently for any unauthorized transactions.

The Position of Wells Fargo and Zelle

Whereas Wells Fargo and Zelle are usually not straight liable for the actions of scammers, they’ve a job to play in mitigating the influence of those scams. Each corporations actively work to teach prospects about these threats and supply sources to assist victims. Nonetheless, the inherent challenges of monitoring and recovering funds despatched through Zelle stay a big hurdle.

Zelle’s velocity and effectivity are additionally its vulnerability. The dearth of purchaser safety makes it a pretty instrument for scammers. Whereas Zelle works with regulation enforcement to research fraudulent actions, the irreversible nature of transactions considerably limits the flexibility to recuperate misplaced funds. This highlights the necessity for continued enhancements in fraud detection and prevention measures by each Zelle and its companion banks.

Conclusion

The Wells Fargo Zelle rip-off is a complicated and pervasive menace that highlights the vulnerabilities of our more and more digital monetary panorama. By understanding the ways employed by scammers and taking proactive steps to guard ourselves, we are able to considerably scale back our danger of turning into victims. Elevated consciousness, improved safety measures, and a collective effort to fight these scams are essential in safeguarding our monetary well-being on this evolving technological atmosphere. Keep in mind, vigilance and skepticism are your finest defenses towards these fraudulent schemes. If one thing feels incorrect, it most likely is. All the time err on the facet of warning and independently confirm any communication claiming to be out of your financial institution.

![How To Quickly Spot a Wells Fargo Scam Text [2023 Update]](https://assets-global.website-files.com/6082ee0e95eb6459d78fac06/637d336591082a3822271157_kN33b6MW-SxYNB-622kpwShXgS4NF9zRhNt33XQtB9SVAGVCdcfIaQOVZZ9cnQYlu4HDkSIneA1-zHafo3GJ3qjupSVIQtp0S5BPmxLZA3mHZ8S2mme5caxfmGc5Y4ssAif3s9hAqjv-iLhhdhMvKOhXCl5buZnm-cYwVSPzI5m5oS6UpCPC3gUYenkyKQ.png)

![How To Quickly Spot a Wells Fargo Scam Text [2023 Update]](https://assets-global.website-files.com/6082ee0e95eb6459d78fac06/637d33641c0fafa2fdaf59ba_tBfNfxhjHhJ8WtjCBweC0ZHaTALpAqeZ8lCkjNc-4u0Xu59A9-A6oLPTK_HuEgWIOCRGQYcQNZ__LCSTuUCHvPNmt1aJkPLDxD37pLbqiLOArAOXuyIU_qs-h8tj-VyTVl7wzgPIauTLWi4Smfh5KBhRypj2Sw5qctK6mqxtIIi57FDOltjcT13W35CORg.jpeg)