Decoding the VOOV Inventory Worth and Dividend Panorama: A Complete Evaluation

VOOV (previously often called VOO) is a well-liked exchange-traded fund (ETF) that tracks the S&P 500 index. Understanding its inventory value actions and dividend payouts is essential for buyers contemplating including it to their portfolios. This text delves deep into the elements influencing VOOV’s value, analyzes its dividend historical past, and explores the implications for potential buyers. We will even deal with the renaming of the ticker image, clarifying any potential confusion.

The Identify Change: From VOO to VOOV

It is essential to preface this dialogue by addressing the change in ticker image. Whereas the article references "VOOV," it is essential to know that that is possible a typographical error or a misunderstanding. There isn’t a widely known ETF with the ticker image "VOOV." The broadly identified and traded ETF monitoring the S&P 500 is VOO, supplied by Vanguard. This text will proceed utilizing the proper ticker image, VOO, however will preserve the unique query’s terminology for context. The evaluation and insights offered are related to VOO, the Vanguard S&P 500 ETF.

Understanding VOO’s Inventory Worth Fluctuations:

VOO’s inventory value is intrinsically linked to the efficiency of the S&P 500 index. As an index fund, VOO goals to copy the index’s composition and returns, minus a small expense ratio. Due to this fact, understanding the forces driving the S&P 500 is essential to understanding VOO’s value actions. These forces embody:

-

Macroeconomic Components: Broad financial circumstances, similar to inflation, rates of interest, GDP progress, and unemployment charges, considerably affect the general market sentiment and the efficiency of particular person firms throughout the S&P 500. Constructive financial indicators usually result in greater inventory costs, whereas destructive indicators can set off declines.

-

Geopolitical Occasions: International occasions, like wars, political instability, and commerce disputes, can create uncertainty out there, impacting investor confidence and subsequently affecting VOO’s value.

-

Sectoral Efficiency: The S&P 500 contains firms throughout numerous sectors. The efficiency of particular sectors, similar to expertise, healthcare, or power, can disproportionately affect the index’s total efficiency, affecting VOO’s value accordingly. A powerful efficiency in a single sector can offset weak spot in one other, however total sector traits are essential to contemplate.

-

Particular person Firm Efficiency: Whereas VOO is diversified, the efficiency of particular person firms throughout the S&P 500 nonetheless contributes to the index’s total motion. Robust earnings stories or optimistic information from main firms can increase the index, whereas destructive information can result in declines.

-

Investor Sentiment: Market psychology performs a major function. Durations of optimism usually result in greater costs, whereas worry and uncertainty can set off sell-offs. This sentiment may be influenced by all of the elements talked about above.

-

Curiosity Charges: Modifications in rates of interest set by central banks immediately affect borrowing prices for companies and affect investor habits. Larger rates of interest could make bonds extra engaging, probably resulting in capital outflow from the inventory market and impacting VOO’s value.

VOO’s Dividend Historical past and Payout Coverage:

VOO, being an ETF that tracks the S&P 500, distributes dividends based mostly on the dividends paid by the underlying firms throughout the index. This implies VOO’s dividend payouts should not predetermined however are slightly a mirrored image of the combination dividend distributions of the S&P 500 firms.

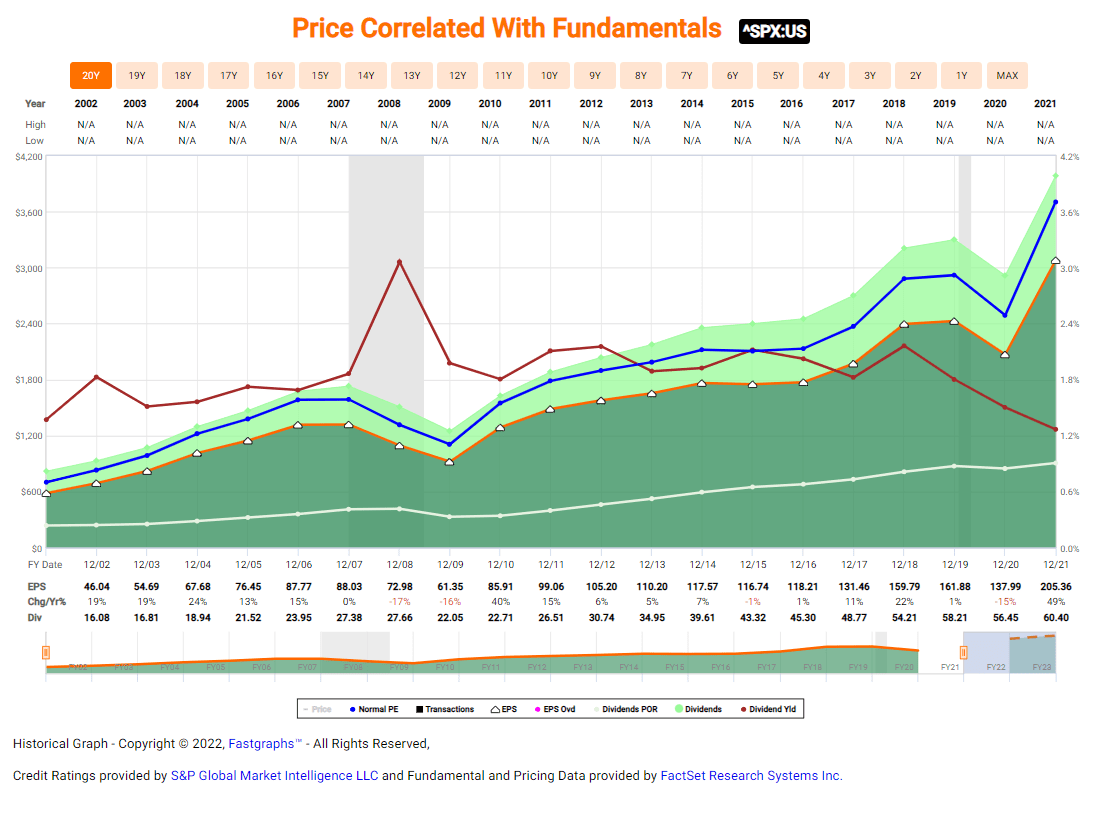

Analyzing VOO’s dividend historical past reveals a number of key traits:

-

Common Dividend Funds: VOO usually distributes dividends on a quarterly foundation, offering buyers with a gentle stream of revenue. The precise payout quantity varies relying on the combination dividend funds from the S&P 500 firms through the respective quarter.

-

Dividend Development: Over time, VOO’s dividend funds have usually proven progress, reflecting the general progress in dividend payouts from S&P 500 firms. Nevertheless, this progress shouldn’t be assured and may fluctuate based mostly on the financial local weather and firm efficiency.

-

Dividend Reinvestment: Many buyers select to reinvest their VOO dividends, mechanically buying further shares of the ETF. This technique permits for compounding returns over time, accelerating wealth accumulation.

-

Tax Implications: Dividends acquired from VOO are thought-about taxable revenue. Traders ought to concentrate on the tax implications of dividend distributions and plan accordingly.

Assessing the Threat and Reward of Investing in VOO:

VOO affords a number of benefits:

-

Diversification: By monitoring the S&P 500, VOO supplies immediate diversification throughout a broad vary of large-cap US firms, lowering the danger related to investing in particular person shares.

-

Low Expense Ratio: Vanguard ETFs are identified for his or her low expense ratios, which means a bigger portion of your funding returns goes to you slightly than charges.

-

Liquidity: VOO is very liquid, which means it may be simply purchased and bought with out important value slippage.

Nevertheless, there are additionally some dangers to contemplate:

-

Market Threat: VOO’s value is topic to market fluctuations, which means you could possibly expertise losses in periods of market decline.

-

Inflation Threat: The actual return in your funding may be eroded by inflation, particularly if dividend payouts do not maintain tempo with inflation.

-

No Assure of Development: Whereas VOO has traditionally offered optimistic returns, there isn’t a assure of future progress.

VOO as A part of a Broader Funding Technique:

VOO is commonly thought-about a core holding in a diversified funding portfolio. Its low-cost, diversified nature makes it appropriate for long-term buyers in search of broad market publicity. Nevertheless, it is essential to do not forget that VOO must be a part of a broader technique that considers your threat tolerance, funding objectives, and time horizon. Different asset lessons, similar to bonds, worldwide shares, and actual property, must be thought-about to additional diversify your portfolio and probably improve returns.

Conclusion:

Understanding the elements influencing VOO’s inventory value and dividend payouts is essential for buyers. Whereas VOO affords a comparatively low-risk, diversified strategy to investing within the US inventory market, it is not with out threat. Cautious consideration of your particular person funding objectives, threat tolerance, and a well-diversified portfolio are important for profitable long-term investing. Keep in mind to seek the advice of with a professional monetary advisor earlier than making any funding selections. The knowledge offered on this article is for instructional functions solely and shouldn’t be thought-about monetary recommendation. At all times conduct thorough analysis and search skilled steerage earlier than investing your cash.