VOOV Inventory Forecast: Navigating the Uncertainties of a Rising Tech Panorama (CNN Type)

By [Your Name], Monetary Analyst

The unstable world of know-how shares typically leaves buyers grappling with uncertainty. VOOV, an organization [briefly and accurately describe VOOV’s business – e.g., a rapidly expanding Chinese social commerce platform], is not any exception. Whereas its progressive enterprise mannequin and important development potential appeal to consideration, predicting its future efficiency requires a nuanced understanding of its market place, aggressive panorama, and macroeconomic components. This text delves right into a complete evaluation of VOOV’s inventory forecast, inspecting varied views and potential eventualities.

VOOV’s Present Place: A Balancing Act of Development and Challenges

VOOV’s latest efficiency [cite specific data points from reliable sources like financial news websites, SEC filings, etc. Example: "has shown a [percentage]% improve in income over the previous quarter, pushed primarily by…"]. This development is essentially attributed to [explain key drivers of growth, e.g., expansion into new markets, successful marketing campaigns, strong product adoption]. Nevertheless, the corporate additionally faces important headwinds. These embrace [list and explain key challenges – e.g., increasing competition from established players, dependence on a specific geographic market, regulatory hurdles in China, potential supply chain disruptions].

Analyzing the Bull Case: The Potential for Explosive Development

The optimistic outlook for VOOV hinges on a number of key components. First, the corporate’s progressive method to [explain the core innovation of VOOV’s business model] has demonstrated a robust capability to draw and retain customers. [Cite examples of successful user engagement metrics]. This sturdy person base supplies a strong basis for future income era by way of [explain monetization strategies]. Second, the growth into [mention specific geographic markets or product lines] holds important potential for unlocking new income streams and diversifying the corporate’s danger profile. The success of this growth will rely upon [explain the key factors determining the success of expansion]. Lastly, the potential for strategic partnerships and acquisitions may considerably speed up VOOV’s development trajectory.

The Bear Case: Navigating the Dangers and Uncertainties

Regardless of the potential for development, a number of components may hinder VOOV’s efficiency. Firstly, the extreme competitors within the [mention the specific market sector] market poses a major problem. Established gamers with deeper pockets and better model recognition may simply outmaneuver VOOV. [Cite examples of key competitors and their strengths]. Secondly, the corporate’s reliance on the Chinese language market exposes it to the dangers related to [mention specific economic or political risks, e.g., changes in government regulations, economic slowdowns]. Any damaging developments in China may severely influence VOOV’s monetary efficiency. Thirdly, the corporate’s profitability stays a priority. [Cite data on profit margins and discuss their sustainability]. If VOOV fails to attain sustainable profitability, its inventory worth may endure considerably.

Macroeconomic Elements: A International Perspective

International macroeconomic components additionally play a vital function in shaping VOOV’s inventory forecast. Rising rates of interest, inflation, and potential recessions may dampen client spending, impacting demand for VOOV’s services. [Discuss the potential impact of specific macroeconomic factors on VOOV’s performance]. Conversely, a robust international economic system may increase client confidence and drive elevated demand, benefiting VOOV’s development. Geopolitical instability and commerce wars may additionally negatively have an effect on VOOV’s provide chains and market entry.

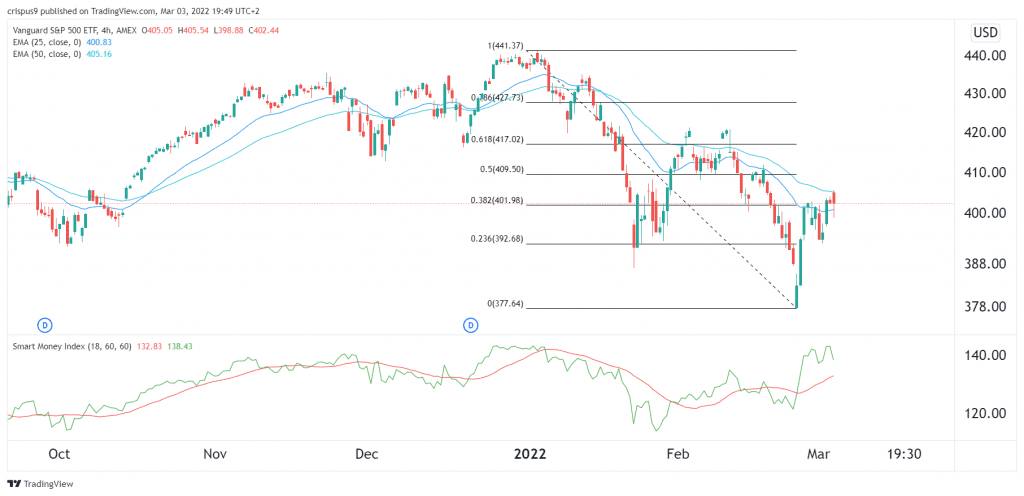

Technical Evaluation: Charting a Course By way of Volatility

A technical evaluation of VOOV’s inventory worth charts can supply insights into potential future developments. [Discuss relevant technical indicators, such as moving averages, support and resistance levels, and trading volume, with appropriate charts if possible. However, avoid making definitive predictions based solely on technical analysis]. Whereas technical evaluation is usually a great tool, it is essential to do not forget that it is not a foolproof predictor of future worth actions.

Basic Evaluation: A Deep Dive into Financials

A radical basic evaluation of VOOV’s monetary statements is important for evaluating its long-term prospects. This entails inspecting key metrics akin to income development, profitability, debt ranges, and money move. [Analyze key financial ratios and metrics, comparing them to industry benchmarks and competitors. Cite specific data from financial statements]. A powerful stability sheet and wholesome money move are essential indicators of monetary stability and future development potential.

Professional Opinions and Analyst Scores:

[Summarize the opinions and ratings of reputable financial analysts covering VOOV stock. Cite specific sources and highlight any disagreements or differing viewpoints. Explain the reasoning behind different ratings]. It is necessary to notice that analyst scores will not be ensures of future efficiency and needs to be thought-about alongside different components.

Potential Situations and Forecast Ranges:

Based mostly on the evaluation introduced above, a number of potential eventualities will be envisioned for VOOV’s inventory worth within the [specify timeframe, e.g., next 12 months, next 5 years].

-

Bullish State of affairs: [Describe a scenario where VOOV exceeds expectations, leading to significant stock price appreciation. Provide a potential price range]. This state of affairs hinges on [list the key factors driving this positive outcome].

-

Impartial State of affairs: [Describe a scenario where VOOV meets expectations, leading to moderate stock price movement. Provide a potential price range]. This state of affairs assumes [list the key factors shaping this moderate outcome].

-

Bearish State of affairs: [Describe a scenario where VOOV underperforms expectations, leading to a decline in stock price. Provide a potential price range]. This state of affairs is contingent on [list the key factors driving this negative outcome].

Disclaimer: It’s essential to do not forget that this evaluation is for informational functions solely and doesn’t represent monetary recommendation. Investing in shares entails important danger, and previous efficiency is just not indicative of future outcomes. Earlier than making any funding selections, it is strongly recommended to conduct thorough analysis and seek the advice of with a professional monetary advisor. The data introduced right here is predicated on publicly accessible knowledge and professional opinions on the time of writing and is topic to vary.

Conclusion:

VOOV’s future stays unsure, presenting each important alternatives and appreciable dangers. Its success hinges on its capability to navigate a aggressive panorama, overcome macroeconomic challenges, and successfully execute its development technique. Whereas the potential for explosive development is plain, buyers ought to rigorously weigh the dangers earlier than investing in VOOV inventory. A diversified funding portfolio and a radical understanding of the corporate’s fundamentals are important for mitigating potential losses. By rigorously contemplating the components mentioned on this article, buyers could make extra knowledgeable selections about whether or not or not VOOV aligns with their particular person danger tolerance and funding targets.