Principality Savings Accounts 2025: Navigating the Future of Personal Finance

As the global economy continues its dynamic evolution, marked by shifting interest rates, inflationary pressures, and the ongoing digital transformation, the importance of a robust and reliable savings strategy has never been more pronounced. For individuals and families across the UK, securing their financial future hinges on making informed decisions about where to entrust their hard-earned money. In this landscape, building societies, with their member-centric ethos and long-standing commitment to community, often stand out as pillars of stability and trust. Among these, Principality Building Society, with its rich heritage and forward-looking approach, is poised to offer compelling Principality savings accounts 2025, tailored to meet the diverse needs of savers in the coming year.

This comprehensive article delves into what savers can expect from Principality savings accounts 2025, exploring the economic context, the range of products likely to be available, the digital advancements enhancing customer experience, and the enduring values that make Principality a compelling choice for securing financial well-being.

The 2025 Economic Canvas: A Backdrop for Savings

Entering 2025, the economic environment is anticipated to remain a complex interplay of factors that directly influence savings. While the peak of post-pandemic inflation may have subsided, central banks, including the Bank of England, will likely continue to manage interest rates carefully, balancing economic growth with price stability. Geopolitical events, supply chain dynamics, and evolving consumer spending patterns will all contribute to a nuanced financial landscape.

For savers, this means a continued need for vigilance and adaptability. Interest rates on savings accounts will remain a critical factor, influenced by the Bank of England’s base rate. While rates may not reach the highs seen during periods of aggressive monetary tightening, competitive offerings will still be vital for protecting and growing capital. Furthermore, the persistent cost of living pressures will underscore the necessity of building emergency funds and saving for long-term goals such as house deposits, retirement, or children’s education. Principality Building Society, deeply rooted in the communities it serves, understands these pressures intimately and is expected to design its Principality savings accounts 2025 to offer genuine value and security.

Principality Building Society: A Legacy of Trust and Mutual Benefit

Founded in Cardiff in 1860, Principality Building Society is the largest building society in Wales and one of the largest in the UK. Unlike banks, which are typically owned by shareholders, building societies are mutual organisations, meaning they are owned by their members (savers and borrowers). This fundamental difference shapes Principality’s operational philosophy: profits are reinvested into the business to benefit members through competitive rates, enhanced services, and community initiatives, rather than being distributed to external shareholders.

This mutual status fosters a deep sense of trust and a long-term perspective. Principality is not driven by short-term profit maximisation but by the sustained financial well-being of its members. This ethos is expected to be a cornerstone of their Principality savings accounts 2025 strategy, focusing on stability, reliability, and excellent customer service, both in their extensive branch network and through their growing digital channels.

A Spectrum of Principality Savings Accounts 2025: Tailored for Every Goal

Principality Building Society is renowned for offering a diverse range of savings products designed to cater to different financial objectives, risk appetites, and access requirements. For Principality savings accounts 2025, we can anticipate a continuation and refinement of these popular categories, alongside potential innovations.

-

Easy Access Savings Accounts:

- What to Expect: These accounts offer the ultimate flexibility, allowing savers to deposit and withdraw funds without notice or penalty. They are ideal for emergency funds, short-term savings goals, or holding money that might be needed quickly.

- 2025 Relevance: In an uncertain economic climate, the liquidity provided by easy access accounts remains crucial. Principality will likely aim to offer competitive variable interest rates, ensuring that members’ funds are readily available while still earning a return. The focus will be on transparent terms and user-friendly access via online banking, mobile app, and branches.

-

Fixed Rate Bonds:

- What to Expect: For savers willing to lock away their money for a set period (e.g., 1, 2, or 3 years), fixed rate bonds typically offer higher, guaranteed interest rates. This predictability is a significant advantage, especially if interest rates are expected to fall.

- 2025 Relevance: If the Bank of England’s base rate stabilises or begins a downward trend, fixed rate bonds from Principality savings accounts 2025 could become highly attractive, allowing savers to secure a good rate before potential market shifts. Principality will likely offer a range of terms to suit different commitment levels.

-

Cash ISAs (Individual Savings Accounts):

- What to Expect: Cash ISAs allow individuals to save up to a certain annual allowance (which may be adjusted for 2025) without paying tax on the interest earned. Principality typically offers both easy access and fixed-rate Cash ISAs.

- 2025 Relevance: With the personal savings allowance potentially shrinking or remaining static for many, the tax-free benefits of Cash ISAs will be more valuable than ever. Principality’s ISA offerings in 2025 will be essential for maximising tax efficiency, helping members keep more of their interest.

-

Notice Accounts:

- What to Expect: These accounts offer a middle ground between easy access and fixed bonds. Savers must give a set period of notice (e.g., 30, 60, 90 days) before withdrawing funds, in return for a slightly higher interest rate than easy access options.

- 2025 Relevance: For those who don’t need immediate access to their funds but also don’t want to commit to a long fixed term, notice accounts from Principality savings accounts 2025 will provide a flexible yet rewarding option, balancing access with improved returns.

-

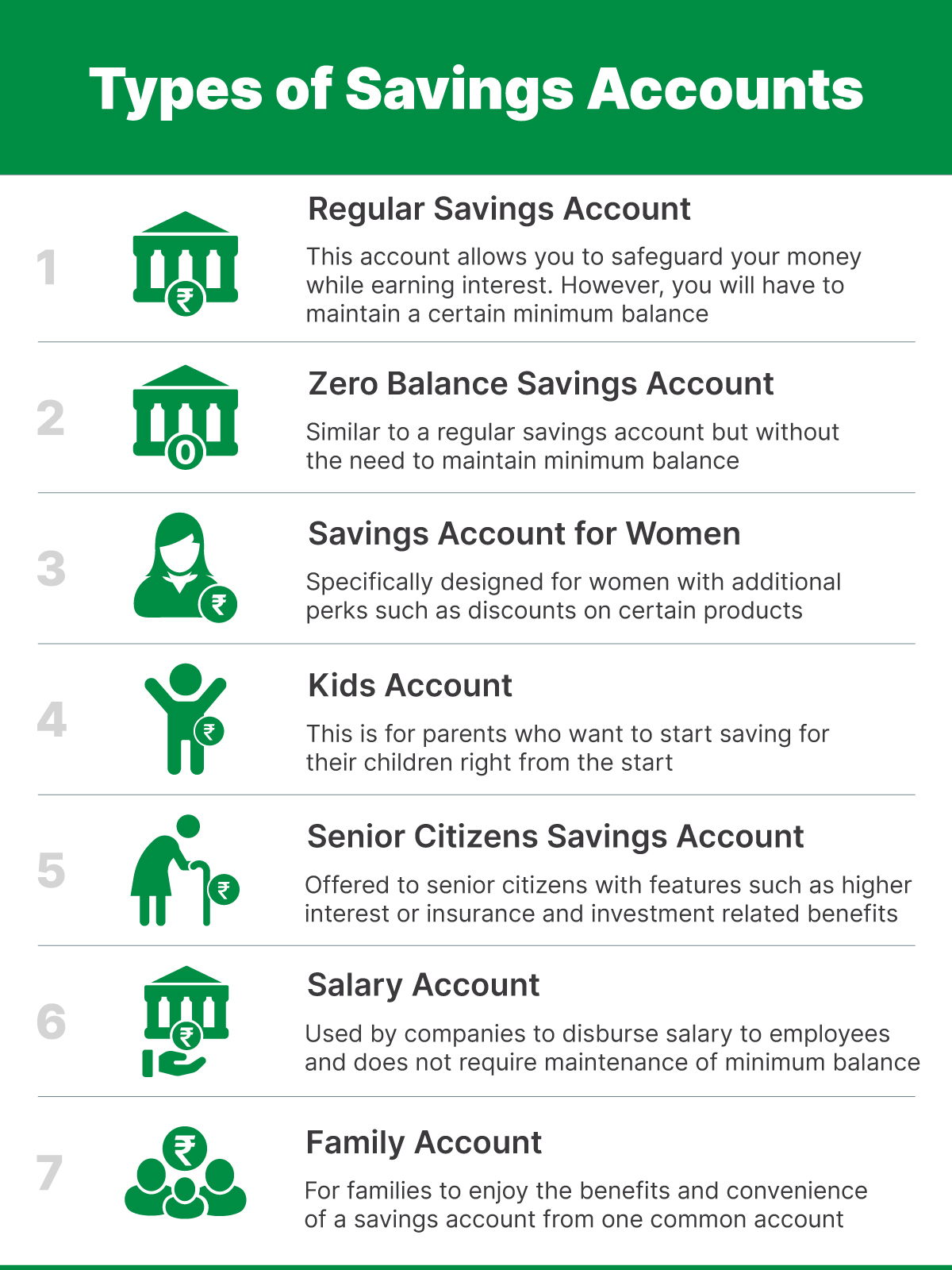

Specialised Accounts:

- What to Expect: Principality also offers accounts tailored for specific demographics or goals, such as Junior ISAs (JISAs) for children’s savings, and potentially regular saver accounts designed to encourage consistent monthly deposits with attractive rates.

- 2025 Relevance: Encouraging long-term saving habits from a young age and providing incentives for regular contributions will remain a key focus. These specialised Principality savings accounts 2025 will support families in building wealth for future generations.

Embracing the Digital Frontier: Seamless Access and Security

While Principality Building Society maintains a strong physical presence through its branch network, it has also made significant strides in its digital transformation. For Principality savings accounts 2025, the emphasis on a seamless, secure, and intuitive digital experience will be paramount.

- Online Banking and Mobile App: Members can expect continued enhancements to Principality’s online banking platform and mobile app, offering features like easy account management, fund transfers, balance checks, and potentially even online account opening for new products. The focus will be on user-friendliness and accessibility.

- Enhanced Security: In an era of increasing cyber threats, Principality will continue to prioritise robust security measures, including multi-factor authentication and advanced encryption, to protect members’ funds and personal data. Trust and security are non-negotiable for any financial institution, and Principality’s commitment in this area will be unwavering.

- Blended Service Model: The strength of Principality lies in its ability to offer a choice. While digital channels provide convenience, the option to visit a local branch for face-to-face advice and support remains a significant advantage for many members, especially those who prefer traditional banking or have complex queries. This blended approach will be a hallmark of Principality’s service in 2025.

The Mutual Advantage: Beyond Just Rates

Choosing Principality savings accounts 2025 is about more than just competitive interest rates; it’s about aligning with an organisation that prioritises its members and the wider community.

- Customer Service Excellence: Building societies are often lauded for their personal and attentive customer service. Principality’s mutual status fosters a culture where members are valued, and their financial well-being is genuinely cared for.

- Community Investment: As a mutual, Principality reinvests a portion of its profits into local communities through sponsorships, charitable partnerships, and financial education initiatives. Savers with Principality contribute indirectly to these positive social impacts.

- Financial Stability and FSCS Protection: Principality Building Society is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Crucially, eligible deposits with Principality are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person, providing an essential layer of security and peace of mind.

Strategic Vision for 2025 and Beyond

Looking ahead to 2025, Principality Building Society’s strategy for savings accounts will likely focus on several key pillars:

- Competitiveness: Continuously reviewing and adjusting rates to remain attractive in a dynamic market.

- Innovation: Exploring new product features or digital tools that enhance the saving experience.

- Personalisation: Leveraging data (with consent) to offer more tailored advice and product recommendations.

- Sustainability: Integrating environmental, social, and governance (ESG) considerations into their operations, appealing to a growing segment of ethically conscious savers.

- Financial Inclusion: Ensuring their products and services are accessible to a wide range of individuals, supporting financial literacy and well-being across all demographics.

Maximising Your Savings with Principality in 2025

For savers considering Principality savings accounts 2025, here are some tips to maximise your financial outcomes:

- Define Your Goals: Understand what you’re saving for (emergency fund, house deposit, retirement) to choose the most appropriate account type.

- Review Regularly: Periodically check Principality’s latest rates and product offerings, as well as your own financial situation, to ensure your savings strategy remains optimal.

- Utilise ISAs: Make the most of your annual ISA allowance to protect your interest from tax.

- Consider a Mix of Accounts: A diversified approach, combining easy access for liquidity with fixed bonds for higher returns on longer-term funds, can be highly effective.

- Seek Advice: If unsure, consider speaking to a financial advisor or Principality’s customer service team to discuss your options.

Conclusion

Principality savings accounts 2025 are set to offer a compelling proposition for individuals seeking a secure, reliable, and rewarding home for their money. In an economic landscape that demands both flexibility and foresight, Principality’s blend of competitive products, robust digital services, and unwavering commitment to its mutual values positions it as a strong choice. By understanding the diverse range of accounts available and leveraging the benefits of a member-owned institution, savers can confidently navigate the financial future, knowing their funds are in trusted hands, working hard to achieve their aspirations.