Will Nvidia Inventory Hold Rising? A Deep Dive into the Way forward for a Tech Titan

Nvidia, the once-niche graphics processing unit (GPU) maker, has reworked right into a behemoth dominating not simply gaming but additionally synthetic intelligence (AI), knowledge facilities, and high-performance computing. Its meteoric rise has captivated buyers, prompting the essential query: will Nvidia inventory continue to grow? The reply, as with all funding, is complicated and is dependent upon a confluence of things. This text delves deep into the corporate’s present place, future prospects, potential dangers, and finally, makes an attempt to offer a nuanced perspective on the sustainability of Nvidia’s development trajectory.

Nvidia’s Present Dominance: A Basis for Future Progress

Nvidia’s present success rests on a number of pillars:

-

AI Revolution: The explosive development of generative AI, fueled by giant language fashions (LLMs) like GPT-4, has catapulted Nvidia to the forefront. Its GPUs, notably the A100 and H100 sequence, are the workhorses powering these AI fashions, offering the immense computational energy wanted for coaching and inference. This demand is insatiable, driving important income development and solidifying Nvidia’s place because the dominant participant within the AI {hardware} market. The current launch of the GH200 Grace Hopper Superchip additional solidifies this dominance, providing unprecedented efficiency for AI workloads.

-

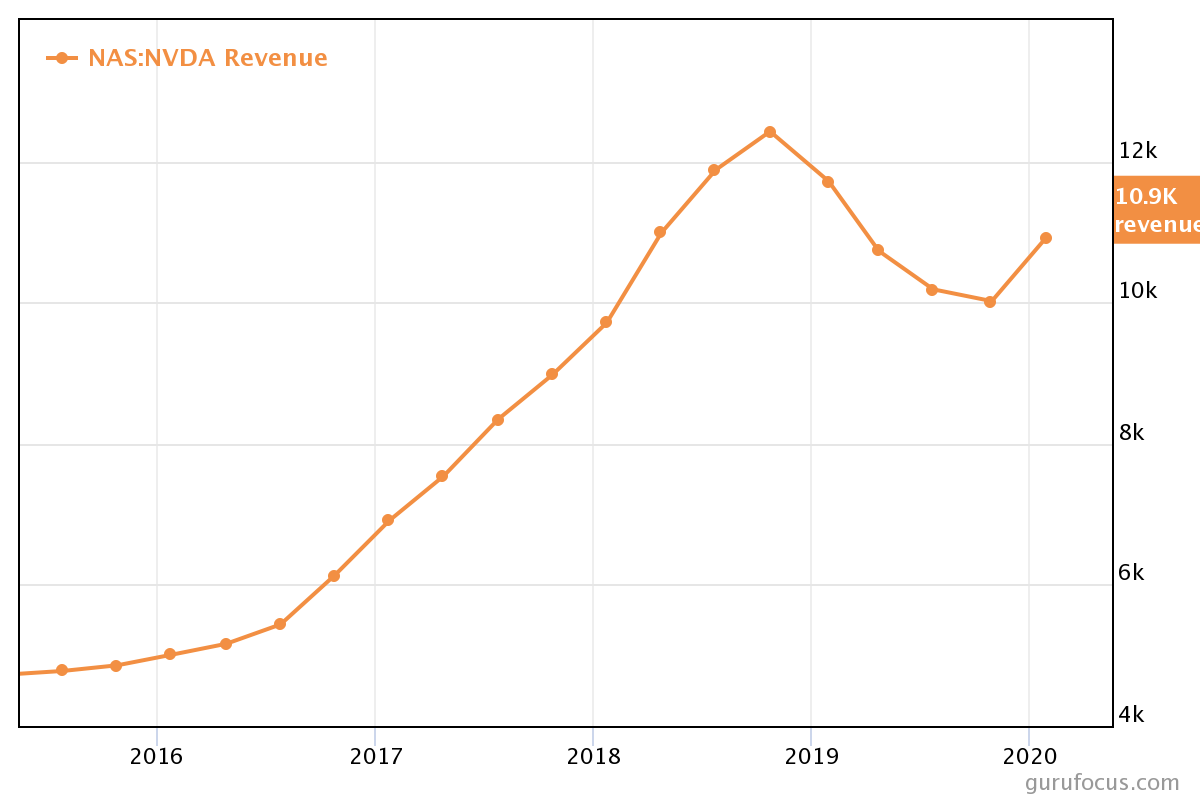

Knowledge Middle Growth: Past AI, the broader knowledge middle market is experiencing explosive development. Cloud computing, huge knowledge analytics, and high-performance computing all require highly effective GPUs, and Nvidia is well-positioned to capitalize on this pattern. Its knowledge middle income has persistently outperformed expectations, demonstrating the energy and resilience of this phase.

-

Gaming Stays a Robust Basis: Whereas AI and knowledge facilities are driving essentially the most important development, Nvidia’s gaming phase stays a considerable contributor to income. The continuing demand for high-performance gaming PCs and consoles ensures a constant stream of earnings, offering a buffer towards potential downturns in different sectors. The metaverse, although nonetheless nascent, additionally presents a possible long-term development alternative for Nvidia’s gaming applied sciences.

-

Automotive Developments: Nvidia’s foray into the automotive sector, notably with its DRIVE platform for autonomous automobiles, represents a big long-term development alternative. The growing adoption of superior driver-assistance programs (ADAS) and the eventual rollout of absolutely autonomous automobiles will create substantial demand for Nvidia’s high-performance computing options. This market continues to be creating, however its potential is gigantic.

Components that May Gas Continued Progress:

-

Continued AI Developments: The AI revolution continues to be in its early levels. As AI fashions turn out to be extra complicated and require even larger computational energy, the demand for Nvidia’s GPUs will probably proceed to develop. Additional breakthroughs in AI algorithms and purposes will solely amplify this demand.

-

Growth into New Markets: Nvidia is actively exploring new markets, comparable to robotics, healthcare, and scientific analysis, the place its GPUs can present important computational benefits. Profitable growth into these areas might unlock new avenues for development.

-

Robust Ecosystem and Partnerships: Nvidia has cultivated a sturdy ecosystem of software program builders, researchers, and companions, which strengthens its place out there. These partnerships facilitate the event and adoption of its applied sciences, additional driving demand.

-

Innovation and Technological Management: Nvidia has a historical past of innovation and technological management. Its constant launch of cutting-edge GPUs ensures it stays on the forefront of the business, sustaining its aggressive benefit.

Potential Dangers and Challenges:

-

Competitors: Whereas presently dominant, Nvidia faces growing competitors from AMD, Intel, and different gamers coming into the AI {hardware} market. These rivals are investing closely in R&D, probably eroding Nvidia’s market share sooner or later.

-

Financial Slowdown: A world financial slowdown might negatively influence demand for Nvidia’s merchandise, notably within the gaming and knowledge middle sectors. Companies may postpone investments in new {hardware} in periods of uncertainty.

-

Provide Chain Disruptions: The worldwide semiconductor business is inclined to produce chain disruptions. Any important disruptions might influence Nvidia’s skill to satisfy the excessive demand for its merchandise, probably affecting income and development.

-

Regulatory Scrutiny: Nvidia’s dominance within the AI {hardware} market might appeal to regulatory scrutiny, probably resulting in antitrust investigations or different regulatory hurdles.

-

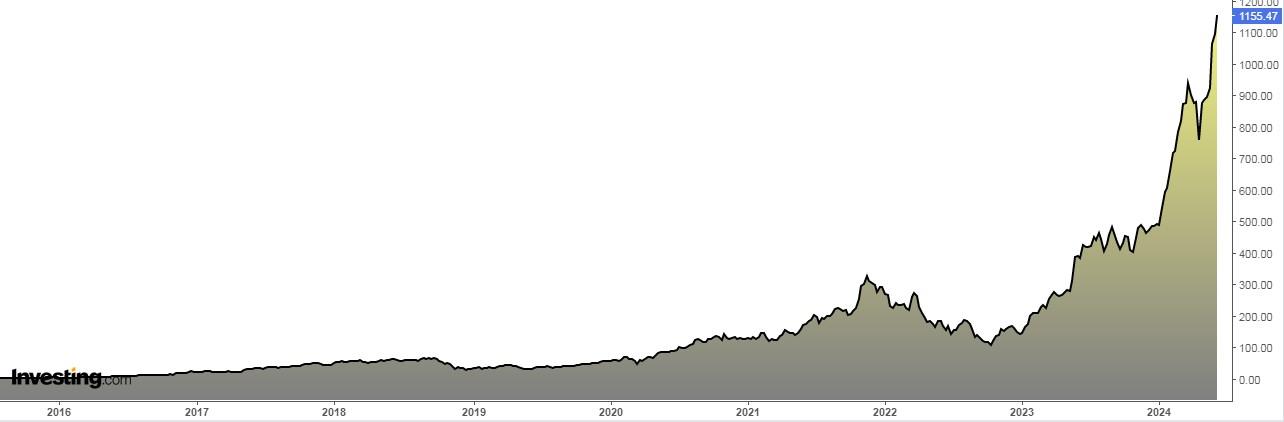

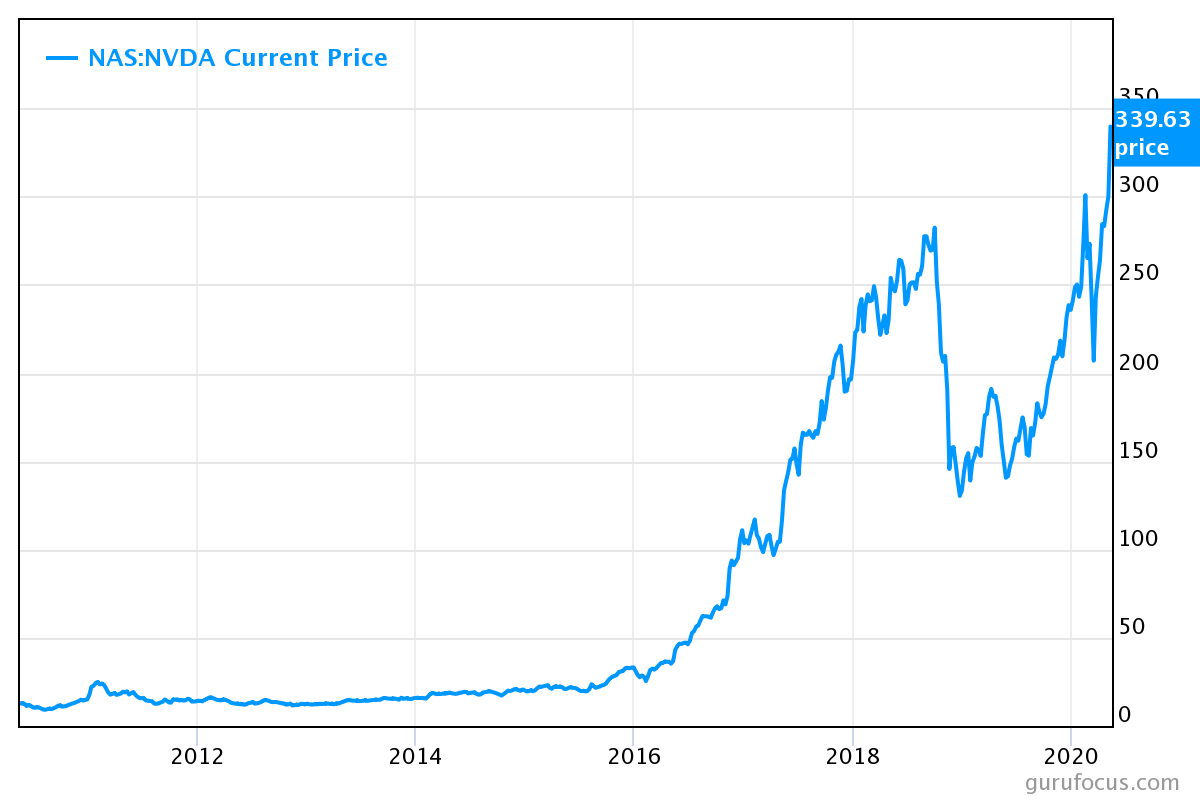

Overvaluation: Nvidia’s inventory value has skilled a exceptional surge, main some analysts to consider it is perhaps overvalued. A correction within the inventory value is at all times a chance, particularly if development fails to satisfy inflated expectations.

Conclusion: A Cautious Optimism

Nvidia’s present place is undeniably robust. Its dominance within the AI {hardware} market, coupled with its presence in different key sectors, offers a stable basis for future development. Nonetheless, it is essential to acknowledge the potential dangers and challenges. Competitors is intensifying, financial uncertainty persists, and the opportunity of a inventory value correction stays.

Due to this fact, whereas a continued development trajectory for Nvidia is believable, it isn’t assured. Traders ought to method Nvidia inventory with a balanced perspective, contemplating each the substantial development potential and the inherent dangers concerned. Thorough due diligence, diversification of investments, and a long-term funding horizon are essential for navigating the complexities of this dynamic market. The way forward for Nvidia, and its inventory value, will rely upon its skill to keep up its technological management, successfully handle competitors, and efficiently navigate the evolving panorama of the AI and broader expertise sectors. The corporate’s continued innovation and strategic partnerships shall be key determinants in whether or not its exceptional development story continues to unfold. Finally, the reply to the query "Will Nvidia inventory continue to grow?" stays unsure, however the potential for important returns, coupled with the inherent dangers, makes it a compelling funding alternative for these with a high-risk tolerance and a long-term perspective.