Navigating the VOO Panorama: Discovering the Finest ETF for Your Portfolio

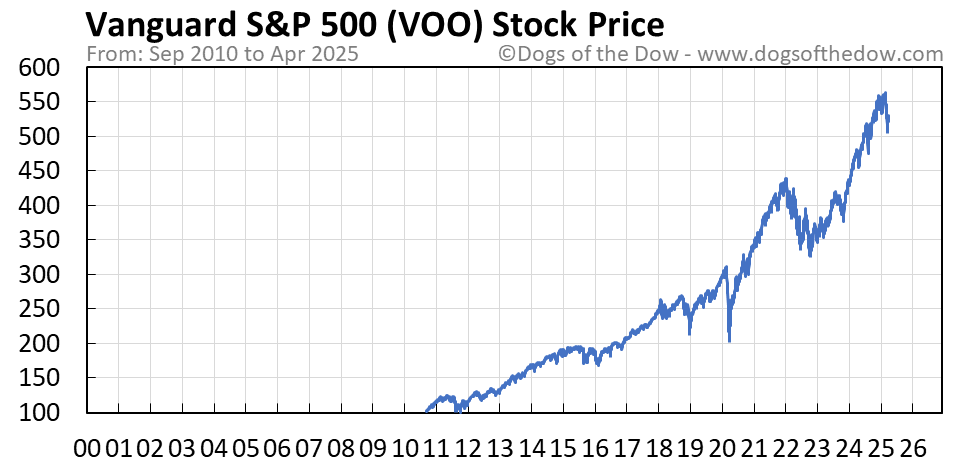

The Vanguard S&P 500 ETF (VOO) is a well-liked alternative for traders in search of broad market publicity, however understanding its nuances and evaluating it to alternate options is essential for maximizing returns and minimizing threat. This text delves deep into VOO, exploring its strengths and weaknesses, and evaluating it to different potential ETFs that will help you decide if it is the "finest" possibility for your particular funding targets and threat tolerance. There isn’t any single "finest" ETF, as the perfect alternative relies upon closely on particular person circumstances.

Understanding VOO: A Deep Dive into the Vanguard S&P 500 ETF

VOO tracks the S&P 500 index, a market-capitalization-weighted index of 500 large-cap U.S. firms. This implies VOO’s efficiency carefully mirrors the general efficiency of those 500 firms, providing a diversified funding within the American financial system. Its key options embody:

-

Low Expense Ratio: VOO boasts an extremely low expense ratio, sometimes round 0.03%. This implies for each $10,000 invested, you solely pay roughly $3 yearly in charges. This considerably contributes to larger returns over the long run in comparison with ETFs with larger expense ratios.

-

Market-Capitalization Weighted: Bigger firms throughout the S&P 500 maintain a bigger weighting within the index, which means they’ve a higher affect on VOO’s efficiency. Whereas this could result in outsized beneficial properties throughout bull markets pushed by mega-cap tech shares, it could possibly additionally amplify losses throughout downturns if these massive firms underperform.

-

Dividend Distribution: VOO distributes dividends to its shareholders, offering an everyday earnings stream. Nevertheless, the dividend yield is topic to market fluctuations.

-

Tax Effectivity: As a passively managed ETF, VOO usually reveals excessive tax effectivity. Its low turnover fee minimizes capital beneficial properties distributions, which may impression your total tax legal responsibility.

-

Liquidity: Resulting from its reputation and important buying and selling quantity, VOO is very liquid, permitting traders to purchase and promote shares simply with out important worth slippage.

VOO vs. Different S&P 500 ETFs: A Comparative Evaluation

Whereas VOO is a powerful contender, a number of different ETFs monitor the S&P 500, every with its personal set of benefits and downsides. A direct comparability is essential:

-

IVV (iShares CORE S&P 500 ETF): IVV is a really shut competitor to VOO, typically with an almost equivalent efficiency. The expense ratio can be exceptionally low, making it a viable various. The selection typically comes down to non-public desire or brokerage platform availability.

-

SPY (SPDR S&P 500 ETF Belief): SPY is the oldest and arguably hottest S&P 500 ETF. Whereas it has a barely larger expense ratio than VOO and IVV, its excessive liquidity and buying and selling quantity make it engaging to many traders, particularly these engaged in frequent buying and selling.

-

SCHB (Schwab US Broad Market ETF): SCHB affords broader market publicity than VOO, together with small-cap and mid-cap firms, not simply the large-cap firms within the S&P 500. This broader diversification would possibly attraction to traders in search of a much less concentrated portfolio. Nevertheless, this comes on the expense of barely larger expense ratio and probably decrease returns in periods of large-cap dominance.

Past S&P 500: Contemplating Alternate options Based mostly on Funding Objectives

Whereas the S&P 500 affords broad market publicity, it won’t be the optimum alternative for each investor. Your funding targets and threat tolerance ought to dictate your ETF choice. Think about these alternate options:

-

Complete Inventory Market ETFs (e.g., VTI, ITOT): These ETFs present publicity to a broader vary of U.S. shares, together with small-cap and mid-cap firms, providing higher diversification than VOO. This is likely to be preferable for traders with the next threat tolerance and an extended time horizon.

-

Worldwide ETFs: For those who search diversification past the U.S. market, take into account worldwide ETFs that monitor indices just like the MSCI EAFE (Europe, Australasia, Far East) or the MSCI Rising Markets. This reduces your dependence on the U.S. financial system’s efficiency.

-

Sector-Particular ETFs: For those who consider a specific sector (e.g., know-how, healthcare) will outperform the broader market, sector-specific ETFs can supply focused publicity. Nevertheless, this technique comes with considerably larger threat, as sector efficiency could be extremely unstable.

-

Bond ETFs: For a extra conservative method, bond ETFs supply publicity to fixed-income securities, offering stability and probably decrease volatility than inventory ETFs. They’re typically used to stability a portfolio closely weighted in the direction of shares.

Elements to Think about When Selecting an ETF:

Past expense ratios and index monitoring, a number of different elements affect the "finest" ETF alternative:

-

Your Funding Objectives: Are you investing for retirement, a down cost on a home, or one thing else? Your time horizon and threat tolerance will considerably impression your alternative.

-

Threat Tolerance: How a lot volatility are you snug with? Inventory ETFs inherently carry extra threat than bond ETFs.

-

Tax Implications: Think about the tax effectivity of the ETF, notably capital beneficial properties distributions.

-

Brokerage Charges: Some brokerages supply commission-free buying and selling for particular ETFs, probably lowering your total prices.

-

Diversification Technique: How diversified is your total portfolio? Selecting an ETF ought to align along with your broader diversification technique.

Conclusion: The "Finest" VOO Various Is determined by You

Whereas VOO is a stable alternative for broad market publicity with its low expense ratio and powerful monitor report, it is not universally the "finest" ETF. The optimum ETF relies upon fully in your particular person funding targets, threat tolerance, and total portfolio technique. Rigorously take into account your circumstances, examine VOO to alternate options like IVV, SPY, SCHB, and different broader market or sector-specific ETFs, and make an knowledgeable resolution that aligns along with your monetary targets. Keep in mind to seek the advice of with a certified monetary advisor earlier than making any important funding choices. This text offers data for academic functions solely and shouldn’t be thought of monetary recommendation.