VOO ETF Efficiency Evaluation: A Deep Dive into Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (VOO) has grow to be a cornerstone of many funding portfolios, providing a easy, low-cost method to achieve publicity to the five hundred largest publicly traded corporations in america. This text supplies a complete efficiency evaluation of VOO, inspecting its historic returns, threat profile, expense ratio, and evaluating its efficiency to different distinguished index funds. We may even delve into the elements that contribute to its efficiency and talk about potential future concerns for traders.

Historic Efficiency: A Constant Performer

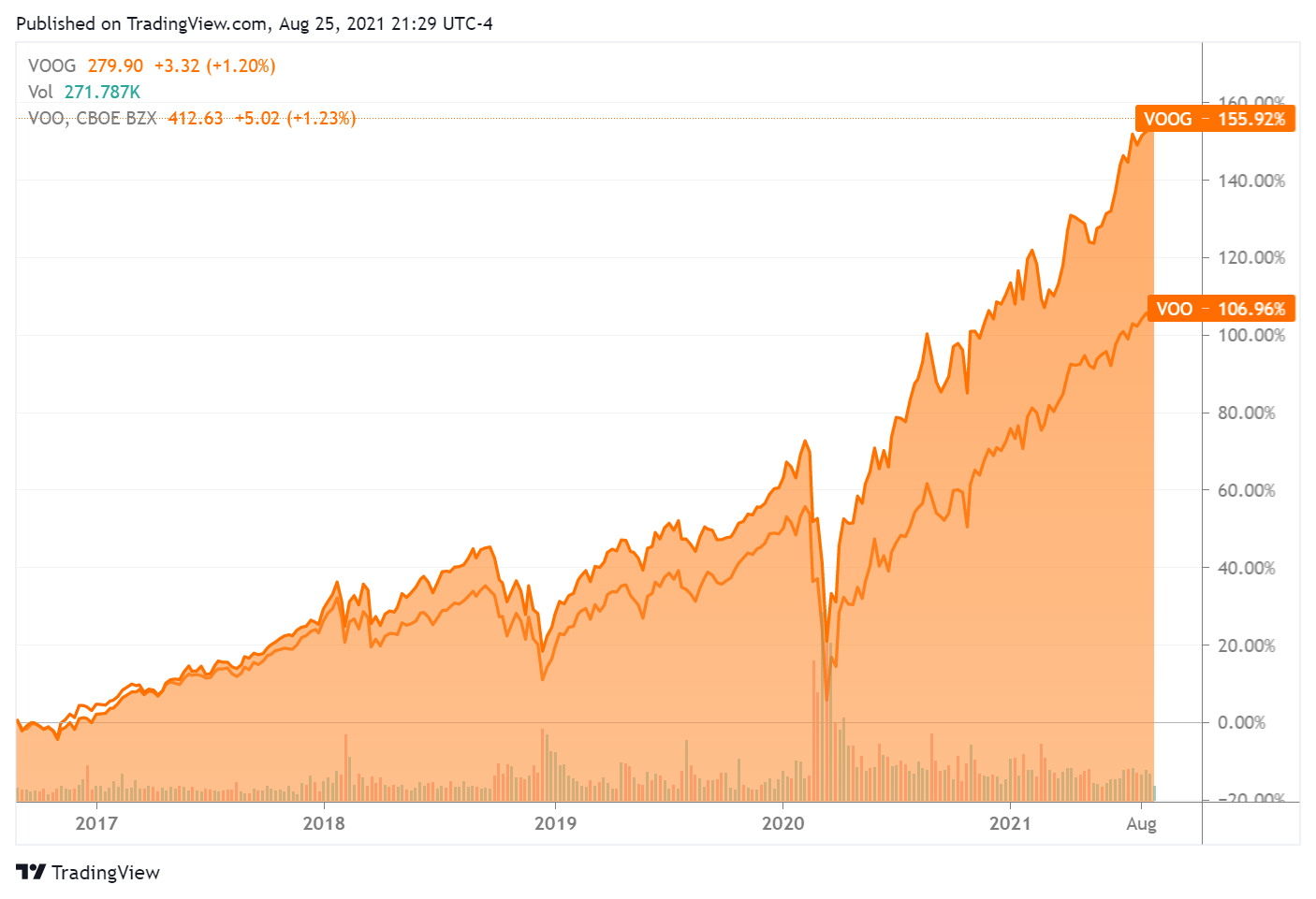

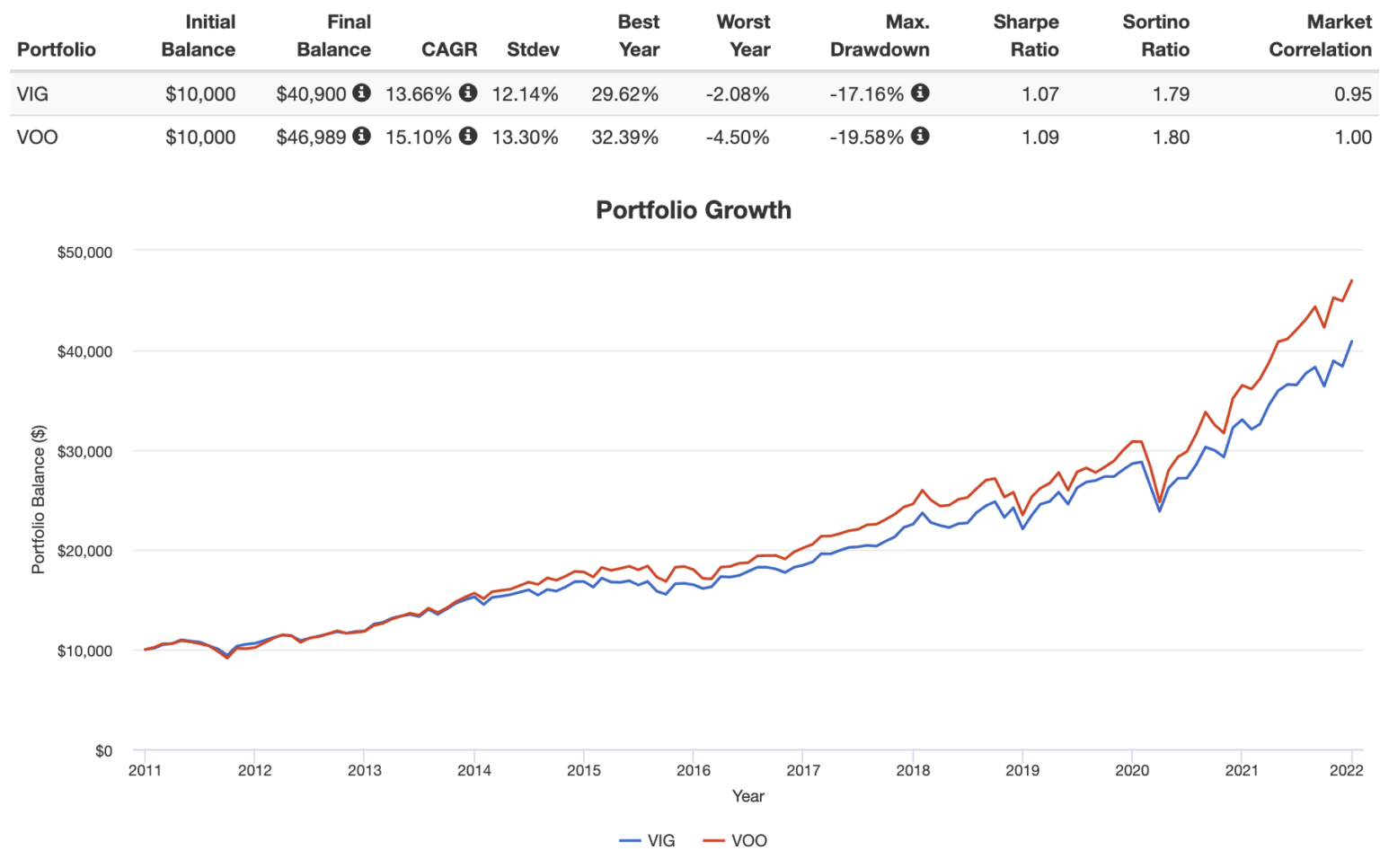

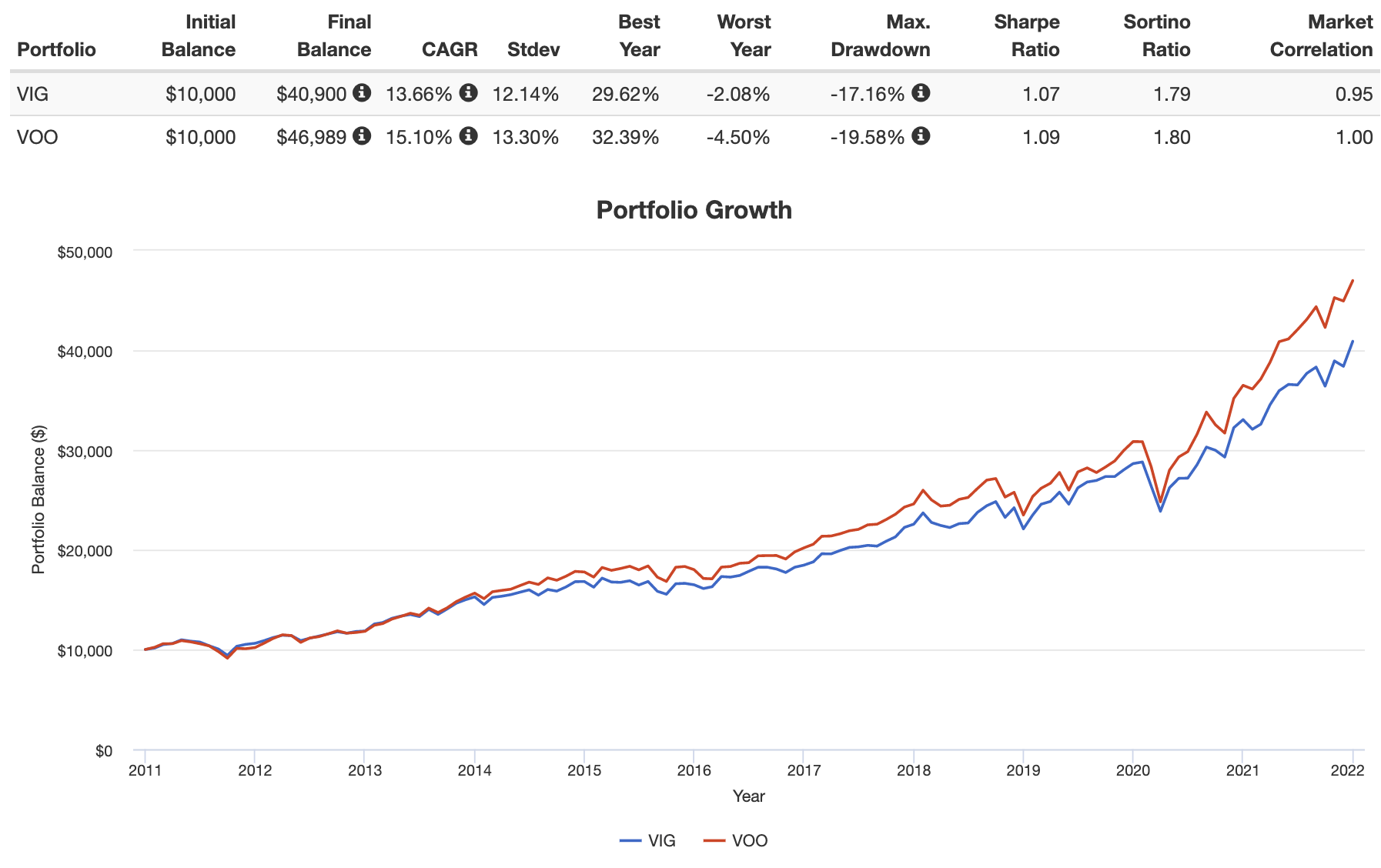

VOO, monitoring the S&P 500 index, mirrors the index’s efficiency, providing traders a diversified publicity to the U.S. economic system. Analyzing its historic efficiency reveals a compelling image of constant progress, albeit with durations of volatility. Knowledge from inception (2010) to the current (adjusting for the particular date of research) exhibits a robust constructive return, considerably outpacing inflation over the long run. Whereas exact figures require referencing present market information, historic efficiency usually displays the S&P 500’s long-term common annual return, which has traditionally been round 10%, although this isn’t assured to proceed.

It is essential to contemplate completely different time horizons when evaluating historic efficiency. Brief-term fluctuations might be vital, notably throughout market corrections or bear markets. Nevertheless, the long-term pattern for VOO, mirroring the S&P 500, has been constantly upward. Buyers ought to give attention to long-term efficiency slightly than being swayed by short-term market fluctuations. Analyzing rolling returns (e.g., 3-year, 5-year, 10-year) supplies a clearer image of constant progress and risk-adjusted returns.

Danger Profile: Volatility and Diversification

Whereas VOO presents diversification throughout numerous sectors, it is essential to know its inherent threat. As a U.S. equity-focused ETF, it is vulnerable to market downturns affecting the general U.S. economic system. In periods of financial uncertainty, VOO’s worth can expertise vital volatility. Analyzing historic information reveals durations of sharp declines, reflecting the inherent threat related to fairness investments. Nevertheless, the diversification throughout the S&P 500 mitigates a number of the threat in comparison with investing in particular person shares.

The beta of VOO is near 1, indicating an identical degree of volatility to the general market. Which means when the market strikes up or down by a sure share, VOO tends to maneuver in an identical route and magnitude. Buyers ought to be comfy with this degree of volatility earlier than investing in VOO. Moreover, understanding the sector weights throughout the S&P 500 and their respective volatilities might help traders assess the particular threat elements impacting VOO’s efficiency.

Expense Ratio: A Key Benefit

VOO boasts a remarkably low expense ratio, a vital issue contributing to its attractiveness. The low expense ratio immediately impacts the investor’s web returns, guaranteeing a bigger portion of the funding’s progress is retained. In comparison with actively managed mutual funds or ETFs with larger expense ratios, VOO’s low price presents a big benefit over the long run. This price effectivity is a big cause for VOO’s recognition amongst traders in search of passive, index-based investments.

The distinction between a excessive and low expense ratio can compound considerably over time, impacting the general returns considerably. Even a seemingly small distinction in expense ratios can translate into a substantial distinction in returns over a number of a long time. Subsequently, VOO’s low expense ratio is a essential issue contributing to its long-term efficiency and total attractiveness.

Comparability to Different Index Funds: IVV, SPY

VOO just isn’t the one ETF monitoring the S&P 500. Different widespread decisions embrace IVV (iShares CORE S&P 500 ETF) and SPY (SPDR S&P 500 ETF Belief). Whereas all three ETFs observe the identical index, minor variations exist of their expense ratios and buying and selling quantity. A direct comparability reveals that the expense ratios are usually very related, making the selection usually a matter of non-public choice or brokerage platform availability. Buying and selling quantity, nonetheless, can impression liquidity and the convenience of shopping for and promoting shares. SPY, with its larger buying and selling quantity, usually presents tighter bid-ask spreads.

The refined variations in efficiency between these ETFs are often negligible over the long run, owing to their shut monitoring of the S&P 500. Buyers ought to prioritize the options that finest go well with their particular person wants and buying and selling fashion, slightly than solely specializing in minute variations in historic efficiency between these very related ETFs.

Components Influencing VOO’s Efficiency:

A number of macroeconomic and microeconomic elements considerably affect VOO’s efficiency. These embrace:

- Total Financial Progress: Sturdy financial progress usually interprets to larger company earnings and elevated inventory costs, positively impacting VOO’s efficiency.

- Curiosity Charges: Modifications in rates of interest have an effect on company borrowing prices and investor sentiment, influencing inventory valuations and VOO’s worth.

- Inflation: Excessive inflation can erode buying energy and negatively impression company earnings, doubtlessly affecting VOO’s returns.

- Geopolitical Occasions: World occasions reminiscent of wars, commerce disputes, and political instability can create uncertainty out there, impacting VOO’s efficiency.

- Sector Efficiency: The efficiency of particular sectors throughout the S&P 500 considerably influences VOO’s total returns. Sturdy efficiency in expertise, healthcare, or different dominant sectors can increase VOO’s efficiency, whereas underperformance in sure sectors can negatively impression it.

Future Issues for Buyers:

Whereas VOO presents a diversified strategy to investing within the U.S. market, traders ought to contemplate a number of elements for future funding choices:

- Market Volatility: The inherent volatility of the inventory market requires a long-term funding horizon to mitigate short-term fluctuations.

- Diversification Past VOO: Whereas VOO presents diversification throughout the U.S. market, traders ought to contemplate diversifying their portfolios throughout completely different asset courses (bonds, worldwide equities, actual property) to scale back total portfolio threat.

- Rebalancing: Repeatedly rebalancing the portfolio to take care of the specified asset allocation might help optimize returns and handle threat.

- Tax Implications: Buyers ought to concentrate on the tax implications related to ETF buying and selling and dividend distributions.

Conclusion:

VOO presents a compelling funding choice for traders in search of publicity to the U.S. inventory market. Its low expense ratio, diversified holdings, and shut monitoring of the S&P 500 make it a gorgeous selection for long-term traders. Nevertheless, understanding its inherent dangers, together with market volatility, and contemplating diversification past VOO are essential for managing threat and optimizing returns. By rigorously analyzing its historic efficiency, threat profile, and evaluating it to related ETFs, traders could make knowledgeable choices that align with their particular person monetary objectives and threat tolerance. Repeatedly reviewing the efficiency and adapting the funding technique based mostly on market situations is important for long-term success. Do not forget that previous efficiency just isn’t indicative of future outcomes, {and professional} monetary recommendation ought to be sought earlier than making any funding choices.